-

1849

Crédit Mutuel begins life in the Rhineland when Friedrich Wilhelm Raiffeisen founds the Flammersfeld farmers' aid society to combat usury. He goes on to found the first local cooperative banks, based on the principles of shared responsibility and a strict equality of power between members: one vote per member, whether lender or borrower.

-

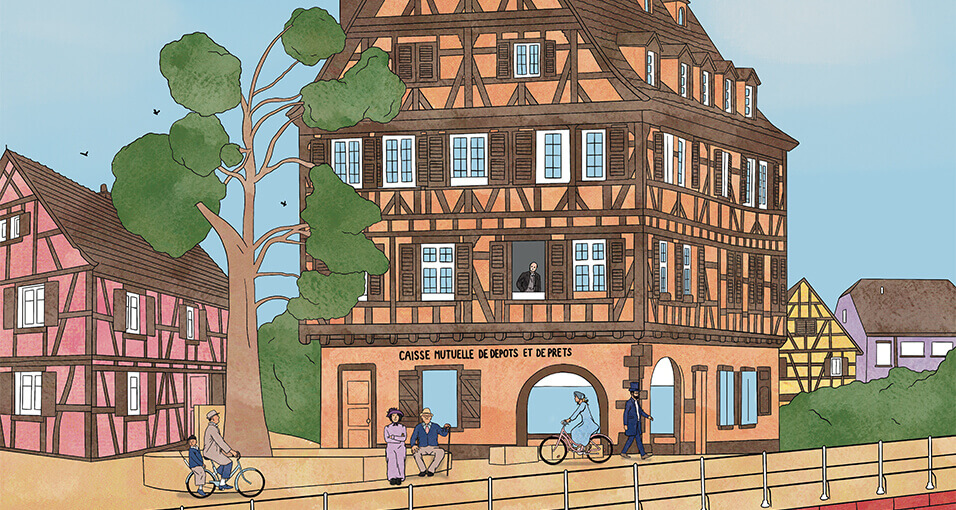

1882

The « Raiffeisen model » crosses the border with the creation of the Caisse de La Wantzenau, a local bank near Strasbourg.

-

1947

The local banks are classified as non-profit organizations and shortly after unite to form a federation.

-

1958

The Order of October 16, 1958 lays down the modern organization of Crédit Mutuel. The Order defines the status of the local banks and that of the Confederation to which the regional federations have belonged since 1959.

-

1993

The Crédit Mutuel Centre Est Europe and Sud-Est federations form the Caisse Fédérale Commune, the foundation of what is today Crédit Mutuel Alliance Fédérale.

-

1998

CIC is acquired by Banque Fédérative du Crédit Mutuel (

BFCM).

-

2002-2012

The Ile-de France (2002), Savoie-Mont Blanc (2006), and Midi-Atlantique (2009) federations join the Caisse Fédérale. In 2011, the Loire-Atlantique et Centre-Ouest, Centre, Normandie, Dauphiné-Vivarais and Méditerranéen federations join to form CM10, which becomes CM11 with the arrival of the Anjou federation in 2012.

-

2018

At the end of the year, the name CM11 is dropped and the name « Crédit Mutuel Alliance Fédérale » is adopted for the body formed by the 11 Crédit Mutuel federations, Banque Fédérative du Crédit Mutuel (

BFCM) and its subsidiaries

-

2020

On January 1st, the Caisse Fédérale will be joined by the Antilles-Guyane and Massif-Central Federations.

-

2020

In October, Crédit Mutuel Alliance Fédérale becomes the first bank to adopt “benefit corporation” status.

-

2020

In December, Crédit Mutuel Alliance Fédérale strengthens its 2019-2023 strategic plan.

-

2022

The 1st January 2022, the Caisse Fédérale is join by the Fédération Crédit Mutuel Nord Europe.