Activity/organization/distribution structure

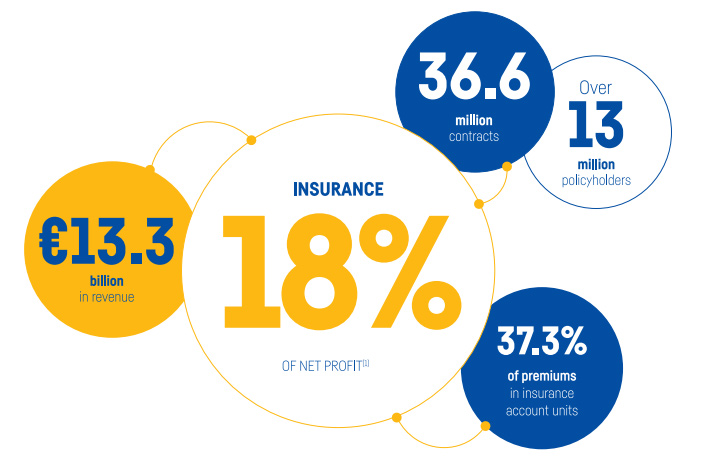

For over 50 years, Insurance has been carried out by Groupe des Assurances du Crédit Mutuel (GACM). A major player in this field in France, it covers the needs of retail, professional and corporate customers.

GACM’s activity has been fully integrated since it was created from a commercial and technological standpoint in Crédit Mutuel Alliance Fédérale. The banking networks are the heart of GACM’s activity in France and abroad, with distribution mainly through the Crédit Mutuel, CIC and Cofidis banking networks. In Belgium, GACM also relies on the Beobank network and its own network of branches.

GACM accompanies its policyholders on a day-to-day basis to protect their families, property, professional activity and their businesses. In savings & retirement insurance, GACM offers a wide range of products that can be adapted to the customer’s objectives : financing projects, preparing for retirement or passing on capital. Customers have a range of delegated management services at their disposal, including packaged formulas, controlled management and arbitrage mandates. As part of its Social and Mutualist Responsibility Policy, GACM has been offering, since the end of 2020, the Pack UC Environnement 50, which gives policyholders the opportunity to invest their savings in account units that finance sustainable development.

The property & casualty insurance marketed makes it possible, notably through motor and multi-risk property insurance policies, to cover personal property and civil liability. GACM also offers insurance covering all risks related to the activity of professionals and companies: premises, equipment, vehicle, professional civil liability and legal protection.

In health insurance, all contracts benefit from access to the Avance Santé card for the payment of healthcare costs without immediate debit. GACM offers a complete range of insurance products for retail customers, professionals and businesses.

Lastly, GACM’s loan insurance covers the loans contracted by retail customers, professionals and businesses in the event of death, incapacity for work or loss of activity. Since 2021, GACM has eliminated loan insurance medical formalities for loyal customers when financing their primary residence1. Crédit Mutuel Alliance Fédérale thus allows loyal customers to no longer be subject to additional premiums or exclusions related to their state of health.

1 Offer subject to cumulative conditions, reserved for the purchase of the main residence, to customers who have domiciled their main income for at least seven years with Crédit Mutuel or CIC, aged less than 62 years, within the limit of an insured capital of €500,000 per borrower, for any first underwriting to ACM of a borrower insurance policy for their main residence, or for any customer. As a reminder, as of 2017, there is no longer any medical screening as of the second underwriting under the medical acceptance retention.